Federal income tax rate 2023 payroll

2021 Tax Rate Schedule for Trusts. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020.

Tax Deadline 2023 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

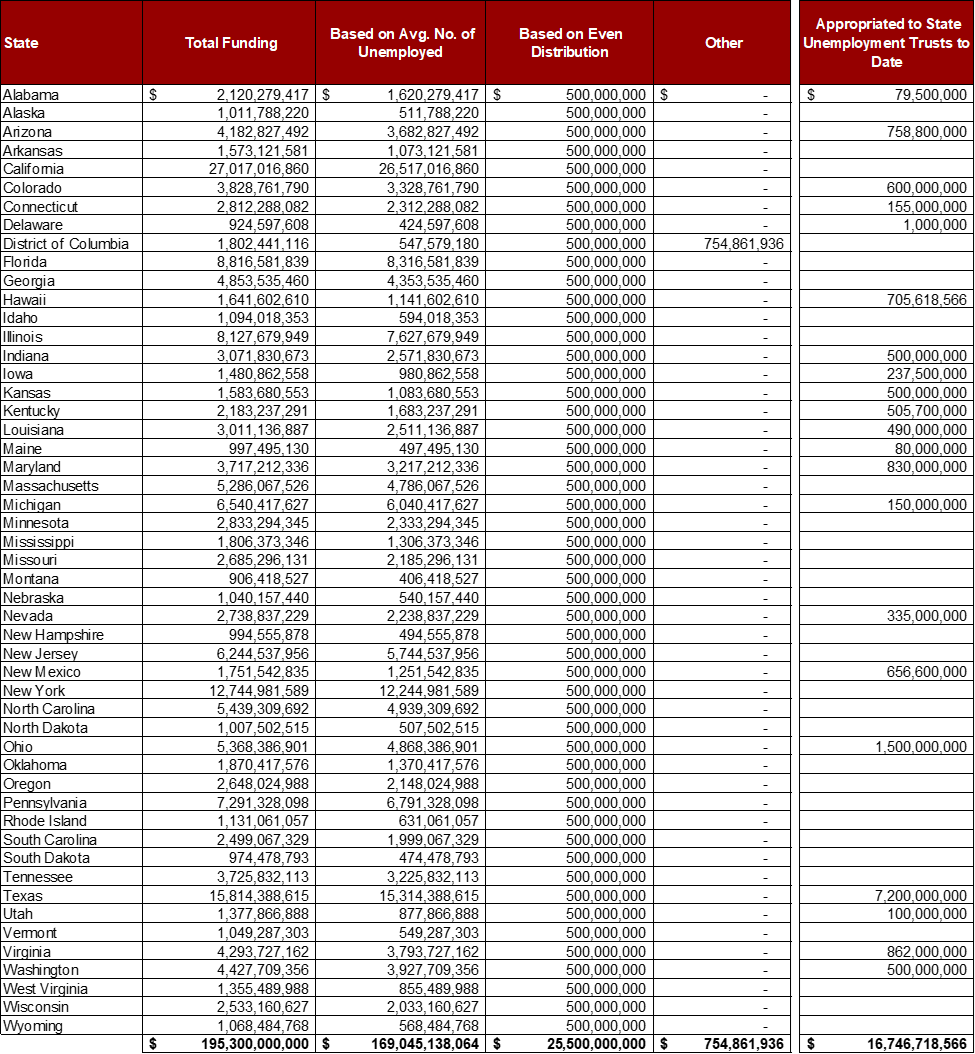

The 2014 United States federal budget is the budget to fund government operations for the fiscal year FY 2014 which began on October 1 2013 and ended on September 30 2014.

. Below 100 to 0 of the portion of your taxable income that exceeds 100. While the federal income tax and the Colorado income tax are progressive income taxes with multiple tax brackets all local income taxes are. 10 tax rate up to 9875 for singles up to 19750 for joint filers 12 tax rate up to 40125.

This discounted FUTA rate can be used if. There are seven federal tax brackets for the 2021 tax year. Actual results will vary based on your tax situation.

Tax Compliance and Complexity. Federal income tax was first. 2021 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households.

Your bracket depends on your taxable income and filing status. Taxable Income Tax Rate. The 2020 federal income tax brackets on ordinary income.

These tax rate schedules are provided to help you estimate your 2021 federal income tax. 10 12 22 24 32 35 and 37. 2022 Federal and State Payroll Taxes Federal Taxes Federal Unemployment FUTA Social Security Tax FICA Medicare Tax FICA Federal Income Tax FIT Employer Pays.

Low and Middle Income Tax Offset LMITO income tax rates and thresholds for 2023. Payers should update their system programming for. Generally California law is the same as federal law.

The first income tax in Australia was imposed in 1884 by South Australia with a general tax on income. And access to up to the prior seven years of tax returns we have on file for you. Nonresidents who work in Montgomery County pay a local income tax of 125 which is 195 lower than the local income tax paid by residents.

Tax Rate For Single Filers Taxable Income For Married Individuals Filing Joint Returns Taxable Income For Heads of Households Taxable Income. A local income tax is a special tax on earned income collected by local governments like counties cities and school districts. The top marginal income tax rate of 37 percent will hit taxpayers with taxable.

Individual income tax rates residents. LMITO does not apply. Tax Expenditures Credits and Deductions.

All UI taxes for 2022 have been paid in full. Self-employed people are responsible for paying the same federal income taxes. Fourteen states including Colorado allow local governments to collect an income tax.

President Obama submitted the FY2014 budget proposal on April 10 2013 two months past the February 4 legal deadline due to negotiations over the United States fiscal cliff and implementation of the. Residents of Montgomery County pay a flat county income tax of 320 on earned income in addition to the Maryland income tax and the Federal income tax. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020.

Actual results will vary based on your tax situation. Income and Payroll Taxes. 2021 Exempt Organization Business Income Tax Booklet.

And access to up to the prior seven years of tax returns we have on. What is a local income tax. ABN to the bank otherwise the bank is required to withhold income tax at the highest rate of tax.

Tions to figure federal income tax withholding on supple-mental wages the methods of withholding described in this publication cant be used if the 37 mandatory flat rate withholding applies or if the 22 optional flat rate withholding is used to figure federal income tax withhold. The tax rate imposed on the unrelated business income of an incorporated exempt organization or association treated as a corporation is 884. 100 to 100 to - 0 of the portion of your taxable income that exceeds 100.

Low income tax offset from 2022 to 2023 18200 37000. The AMT rate is 665.

Social Security What Is The Wage Base For 2023

View All Hr Employment Solutions Blogs Workforce Wise Blog

Estimated Income Tax Payments For 2022 And 2023 Pay Online

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Snowflake Snowflake Reports Financial Results For The Second Quarter Of Fiscal 2023

Income Tax Rates Slab For Fy 2022 23 Or Ay 2023 24 Ebizfiling

State Corporate Income Tax Rates And Brackets Tax Foundation

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

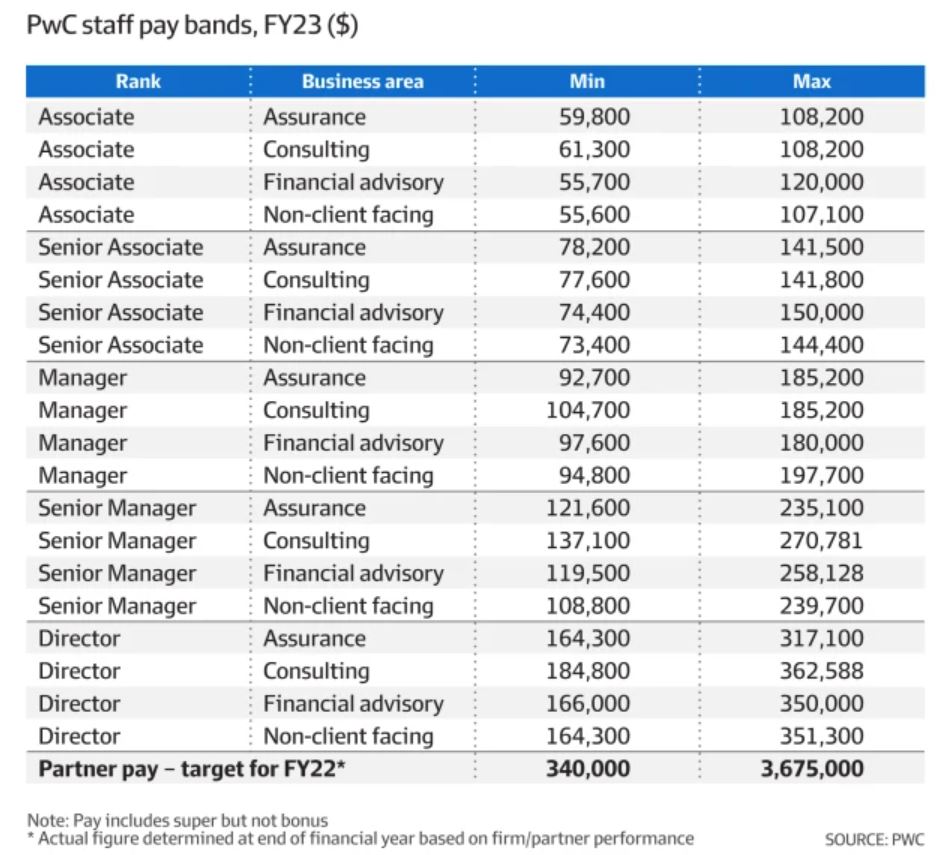

Pwc Releases 2023 Partner Pay Staff Salary The Big 4 Accounting Firms

Biden Budget Biden Tax Increases Details Analysis

Corporation Tax Rate Increase In 2023 From 19 To 25

Income Tax Slab Rates For A Y 2023 24 F Y 2022 23

Net Zero World Initiative International Activities Nrel Peer Learning Lawrence Livermore National Laboratory International Development

2021 2022 Income Tax Calculator Canada Wowa Ca

2022 2023 Tax Brackets Rates For Each Income Level

Early Social Security Ssi Cola Predictions For 2023 Youtube

Latest Income Tax Slab Rates For Fy 2022 23 Ay 2023 24 Budget 2022 Key Highlights Basunivesh